Q. Describe the Circular flow of Income and Expenditure. How is Three-Sector Model different from Four- Sector Model? Discuss

The circular flow

of income and expenditure is a fundamental concept in macroeconomics that

illustrates the continuous movement of money, goods, and services in an

economy. It describes the interactions between different sectors of an economy

and how income is generated, distributed, and spent, creating a loop or cycle

that keeps economic activity ongoing.

The flow of money and goods can be broken down into

two key components:

1.

Real Flow: This refers to the physical movement of

goods and services in the economy. Households supply labor, land, and capital

to firms, while firms provide goods and services to households.

2.

Monetary Flow: This refers to the movement of

money in the economy. Firms pay households wages, rent, interest, and profits

in exchange for the use of their resources, while households spend this income

on purchasing goods and services produced by firms.

In this two-sector model, the economy is seen as

self-contained, with no external influences or interactions with the

government, the foreign sector, or financial markets. This is an idealized

version of the economy, which provides a clear and simple framework to

understand the basic functioning of the economy.

However, real-world economies are more complex, and to

better capture the full range of economic activities, the circular flow model

can be expanded to include additional sectors. These more advanced models

include the three-sector model

and the four-sector model.

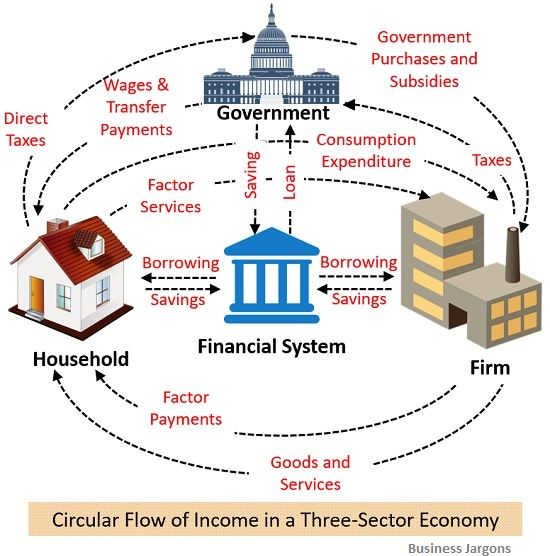

Three-Sector Model of Circular Flow

The three-sector model introduces the government

sector into the circular flow. In this model, three main sectors are involved:

households, firms, and the government. The government interacts with both

households and firms in various ways, primarily through taxation and public

spending.

1. Households: As in the two-sector model, households provide

factors of production (labor, capital, and land) to firms in exchange for

income. They then spend this income on goods and services produced by firms.

2. Firms: Firms produce goods and services and sell them to

households. They also pay wages, rent, interest, and profits to households in

exchange for factors of production. Additionally, firms may be taxed by the

government, which reduces their income and affects their production decisions.

3. Government: The government plays a key role in the economy by

collecting taxes from households and firms. Taxes are a leakage from the

circular flow, as they remove money from the economy. However, the government

also injects money back into the economy through government spending on goods,

services, and welfare programs. These government expenditures create a flow of

income to households and firms, which helps to sustain the economic cycle.

In the three-sector model, the introduction of the

government adds complexity to the circular flow by adding both leakages (taxes)

and injections (government spending). The circular flow becomes more dynamic as

the government seeks to influence economic activity through fiscal policies.

Four-Sector Model of Circular Flow

The four-sector model further expands on the

three-sector model by adding the foreign sector, which includes international

trade. This model incorporates not only households, firms, and the government,

but also foreign markets (exports and imports). In this model, there are four

key sectors:

1. Households: As before, households provide factors of production

and receive income in return. They use their income to purchase goods and

services.

2. Firms: Firms produce goods and services, sell them to

households, and pay income to households in exchange for factors of production.

3. Government: The government collects taxes from households and

firms, and it spends money on public goods and services. Government spending is

considered an injection into the economy, while taxes are a leakage.

4. Foreign Sector: The foreign sector involves trade with other

countries. Exports are an injection into the economy because they bring money

into the country when foreign consumers purchase domestically produced goods

and services. Imports, on the other hand, represent a leakage from the economy,

as money flows out of the domestic economy when households and firms purchase

goods and services produced abroad.

The four-sector model highlights the impact of

international trade on the circular flow of income. Exports provide an

additional source of income for domestic firms, while imports can reduce

domestic economic activity. The balance between exports and imports is referred

to as the trade balance, and it

can have significant implications for the overall health of an economy.

In the four-sector model, leakages (savings, taxes,

and imports) and injections (investment, government spending, and exports) play

a crucial role in determining the level of national income. If injections

exceed leakages, the economy tends to grow, while if leakages exceed

injections, the economy may contract.

Differences Between the Three-Sector and Four-Sector

Models

The primary difference between the three-sector and

four-sector models lies in the inclusion of the foreign sector. Here are some

key differences:

1. Foreign Trade: The four-sector model includes the foreign sector,

which introduces the concepts of exports and imports. This sector allows for

international trade, which can have a significant impact on the domestic

economy. The three-sector model, on the other hand, does not account for trade

with other countries, focusing solely on the domestic interactions between

households, firms, and the government.

2. Injections and

Leakages: Both models

incorporate injections and leakages, but the four-sector model has an

additional set of leakages and injections related to international trade.

Exports are an injection, as they bring money into the economy, while imports

are a leakage, as they represent money flowing out of the economy. The three-sector

model only has leakages and injections from taxes, government spending, and

savings.

3. Economic

Implications: The inclusion of

the foreign sector in the four-sector model makes it more relevant to open

economies that engage in trade with other countries. The trade balance (exports

minus imports) becomes an important determinant of national income and can

affect exchange rates, foreign exchange reserves, and the overall economic

performance of a country. The three-sector model is more applicable to closed

economies, where there is no international trade.

4. Policy

Considerations: In the

three-sector model, government policy can focus on taxation, government

spending, and the redistribution of income within the domestic economy. In the

four-sector model, the government must also consider international trade

policies, such as tariffs, subsidies, and trade agreements, which can influence

the flow of goods and services across borders.

Conclusion

In summary, the circular flow of income and

expenditure is a useful model for understanding how money and goods circulate

in an economy. The basic two-sector model captures the flow between households

and firms, while the three-sector model introduces the government, adding

complexity through taxation and government spending. The four-sector model

further expands on this by incorporating the foreign sector, recognizing the

importance of international trade. Each successive model provides a more

nuanced view of the economy, with the four-sector model offering the most comprehensive

understanding of economic activity in an open economy.

The transition from the two-sector to the three-sector

model, and then to the four-sector model, illustrates the growing complexity of

the circular flow as more sectors are included. The three-sector and

four-sector models allow economists to analyze a wider range of economic

issues, such as fiscal policy, trade balances, and the impact of international

events on the domestic economy. Ultimately, understanding the circular flow of

income and expenditure helps policymakers and economists make informed

decisions that can influence the overall health and stability of the economy.

0 comments:

Note: Only a member of this blog may post a comment.