Q. “A budget is a means and budgetary control is the end result”. Explain.

A

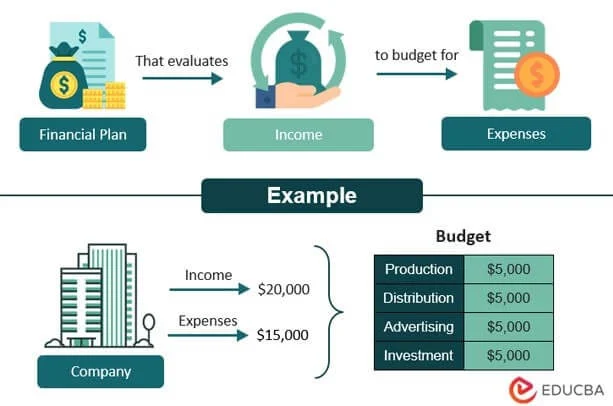

budget is a fundamental financial tool used by organizations, governments, and

individuals to plan and allocate resources effectively over a specified period,

usually a fiscal year. It serves as a comprehensive financial plan that

outlines expected revenues, expenditures, and savings, providing a roadmap for

how financial resources will be utilized to achieve specific goals. Budgeting

is essential for effective financial management, as it helps decision-makers

prioritize spending, manage cash flow, and allocate resources efficiently.

Budgetary control, on the other hand, refers to the process of monitoring and

managing financial performance in relation to the established budget. It

involves comparing actual financial results to the budgeted figures, identifying

variances, and taking corrective actions to ensure that financial objectives

are met.

When

we say, “A budget is a means, and budgetary control is the end result,” we are

essentially highlighting the dynamic relationship between these two concepts. A

budget, in this context, is the planning tool or mechanism that sets the

framework for financial management, while budgetary control is the ongoing

process that ensures the budget is adhered to and that any discrepancies

between the planned and actual performance are addressed effectively. In this

discussion, we will explore the meaning of budgeting and budgetary control, how

they complement each other, and why the relationship between them is crucial

for financial success.

The Role of Budgeting as a Means

Budgeting

is the initial step in the financial management process. It provides a detailed

financial outline of what an organization intends to achieve during a specific

period. The budget reflects the organization's financial goals, strategies, and

priorities, and it serves as a guiding document for decision-making. A budget

sets the tone for how resources should be allocated across various departments

or areas of operation. It helps management and stakeholders understand how

financial resources will be distributed, ensuring that funds are directed

toward the most critical activities.

1. Setting Financial Goals and Objectives

One

of the primary functions of budgeting is to define the financial objectives

that the organization seeks to achieve. These goals may include increasing

profits, reducing costs, improving cash flow, or funding new initiatives. For

instance, a government budget may prioritize education, healthcare, or

infrastructure projects, while a company’s budget may focus on increasing

revenue, expanding market share, or launching new products. Without a budget,

organizations might struggle to clarify their financial goals and direct

resources effectively toward achieving them.

Example: A company may set a goal of increasing its sales revenue

by 10% over the next year. To achieve this, the company allocates a specific

budget for marketing, sales promotions, and product development. The budget

outlines how much money will be spent on each of these activities, ensuring

that the company’s resources are used efficiently to meet its financial

objectives.

2. Allocating Resources Efficiently

Budgeting

serves as a means to allocate limited financial resources across various

departments, functions, or projects. By clearly defining how much money will be

allocated to each area, budgeting helps organizations avoid overspending or

underfunding critical activities. It also forces decision-makers to prioritize

initiatives that align with the organization’s strategic goals, ensuring that

funds are allocated to the most important areas.

Example: In a manufacturing company, the budget may allocate a

portion of funds for purchasing raw materials, another portion for labor costs,

and yet another for maintenance and repair of machinery. By establishing these

allocations, the company can ensure that all necessary activities are

adequately funded while avoiding overspending in any particular area.

3. Planning for the Future

A

budget provides a financial roadmap for the future. It allows organizations to

anticipate revenue and expenditure patterns and to plan accordingly. By

forecasting future financial conditions, budgeting helps identify potential

cash shortfalls, funding gaps, or surplus funds. This enables management to

take proactive measures to mitigate risks or capitalize on opportunities before

they arise.

Example: A nonprofit organization that relies on donations may

forecast a decline in contributions during certain months of the year. The

organization can plan ahead by adjusting spending or seeking additional sources

of funding during these periods, ensuring that its operations continue smoothly

despite fluctuations in revenue.

4. Guiding Decision-Making

Budgeting

plays a critical role in decision-making, as it provides managers with the

financial data and projections needed to make informed choices. The budget

helps organizations evaluate the financial implications of different strategies

or decisions, making it easier to select the most financially viable options.

It also acts as a reference point for evaluating the performance of different

business units, projects, or programs.

Example: A retail chain may use its budget to evaluate the

feasibility of opening a new store in a different location. By comparing the

projected costs and revenues from the new store with the budgeted figures for

existing stores, the management can determine whether the investment is

financially viable.

Budgetary Control as the End Result

While

budgeting is about setting a financial plan for the future, budgetary control

is the process of ensuring that the plan is executed as intended. Budgetary

control involves monitoring actual financial performance against the budget,

identifying variances, and taking corrective actions when necessary. It is an

ongoing process that ensures that the organization stays on track to meet its

financial goals, and it plays a crucial role in maintaining financial

discipline and accountability.

1. Monitoring Financial Performance

Budgetary

control begins with tracking actual financial performance and comparing it to

the budgeted figures. This monitoring process involves collecting data on

revenues, expenditures, and other financial metrics, such as cash flow or

profitability, on a regular basis. The comparison between actual results and

budgeted targets allows organizations to assess whether they are on track to

meet their financial objectives or whether corrective actions are needed.

Example: A company may track its monthly sales revenue and compare

it with the revenue targets outlined in the budget. If the actual sales are

below the budgeted figures, management may need to investigate the reasons for

the shortfall and take appropriate action to rectify the situation.

2. Identifying Variances and

Analyzing Causes

Once

actual performance is compared with the budget, variances—either favorable or

unfavorable—are identified. Favorable variances occur when actual results

exceed the budgeted figures, while unfavorable variances occur when actual

results fall short of expectations. Identifying and analyzing these variances

is a crucial step in budgetary control, as it helps pinpoint the underlying

causes of discrepancies.

Example: If a company has a higher-than-expected expenditure on raw

materials, budgetary control would involve analyzing the causes of this

increase. It could be due to inflationary price increases, higher production

volumes, or inefficiencies in procurement. Identifying the cause of the

variance allows management to take corrective actions, such as renegotiating

supplier contracts or finding ways to optimize production processes.

3. Taking Corrective Actions

Once

variances have been identified and analyzed, budgetary control focuses on

taking corrective actions to bring actual performance back in line with the

budget. These actions may involve adjusting spending, reallocating resources,

revising goals, or implementing cost-cutting measures. Corrective actions are

necessary to prevent significant financial deviations that could impact the

organization’s overall financial health or ability to achieve its goals.

Example: If a department is exceeding its budget due to excessive

spending on travel expenses, the department head may take corrective actions by

reducing non-essential trips, opting for less expensive accommodations, or

finding alternative ways to conduct meetings and training. By making these

adjustments, the department can bring its expenses in line with the budgeted

figures.

4. Maintaining Accountability and

Financial Discipline

Budgetary

control ensures that there is accountability at all levels of the organization.

By regularly comparing actual performance with the budget, managers are held

responsible for adhering to financial targets and ensuring that resources are

used efficiently. This fosters a culture of financial discipline and encourages

managers to make decisions that align with the organization’s strategic

objectives.

Example: In a public sector organization, budgetary control ensures

that departments remain accountable for their spending. If a department

overspends its allocated budget, it may face consequences, such as reduced

funding for future projects or closer scrutiny of its financial decisions. This

encourages departments to stick to their budgets and prioritize spending

effectively.

5. Improving Financial Efficiency

Budgetary

control contributes to the overall efficiency of financial management within an

organization. By continuously monitoring performance and making adjustments,

organizations can avoid waste, reduce inefficiencies, and improve the

allocation of resources. This results in better financial outcomes and greater

value for money.

Example: A company may identify inefficiencies in its production

process that lead to higher costs than anticipated in the budget. Budgetary

control enables the company to take corrective measures, such as investing in

more efficient machinery or optimizing labor costs, thereby improving financial

efficiency and profitability.

The Relationship Between Budgeting

and Budgetary Control

The

relationship between budgeting and budgetary control is synergistic. Budgeting

sets the stage for financial planning and resource allocation, while budgetary

control ensures that the organization remains on track to achieve its financial

objectives. Budgeting provides the financial framework and targets, and

budgetary control ensures that performance is monitored and adjusted as

necessary to stay within the defined parameters.

In

essence, a budget is the starting point or means by which an organization plans

its financial activities, while budgetary control represents the ongoing

process of managing and adjusting those plans to achieve the desired outcomes.

Without a budget, it would be difficult to establish clear financial goals, and

without budgetary control, it would be impossible to ensure that the

organization is staying on track to achieve those goals.

Conclusion

“A

budget is a means, and budgetary control is the end result” highlights the

essential relationship between financial planning and the monitoring of

performance. Budgeting provides the framework for allocating resources and

setting financial goals, while budgetary control ensures that actual

performance aligns with the planned budget. By setting clear financial targets,

monitoring performance, and taking corrective actions when necessary,

organizations can ensure that they achieve their financial objectives and

maintain financial stability. The combination of effective budgeting and

budgetary control is crucial for the success of any organization, whether it is

a government agency, a corporation, or an individual managing their personal

finances. Together, these two processes form the cornerstone of sound financial

management.

0 comments:

Note: Only a member of this blog may post a comment.